| Who are these callers and why is it so important that they reach you about your car’s extended warranty? |

Imagine you’re enjoying the warmth from sipping a hot cup of coffee on a crisp morning. Suddenly, your phone rings and a familiar voice cuts through the tranquillity. It’s your old friend, Mark. With urgency, he explains he’s calling from a care facility, where he’s been battling a prolonged illness and desperately requires money for treatment. The call then abruptly ends Caught in a wave of emotional concern, you disregard your usual caution and send him the requested sum. Later in the day, a conversation with another friend casually mentions Mark’s phone call. Your heart sinks as you learn of 10 other similar calls – each with a different story from Mark. It turns out that Mark never called you, nor the 10 others. This raises a chilling question: how did the scammer obtain your number and impersonate your friend with such an accuracy?

As you delve deeper, you discover that a recent change in your social media settings made your contact information publicly available, making it easily available to the scammer. And the scammer did not miss this opportunity to craft a false story to exploit your trust and emotional vulnerability.

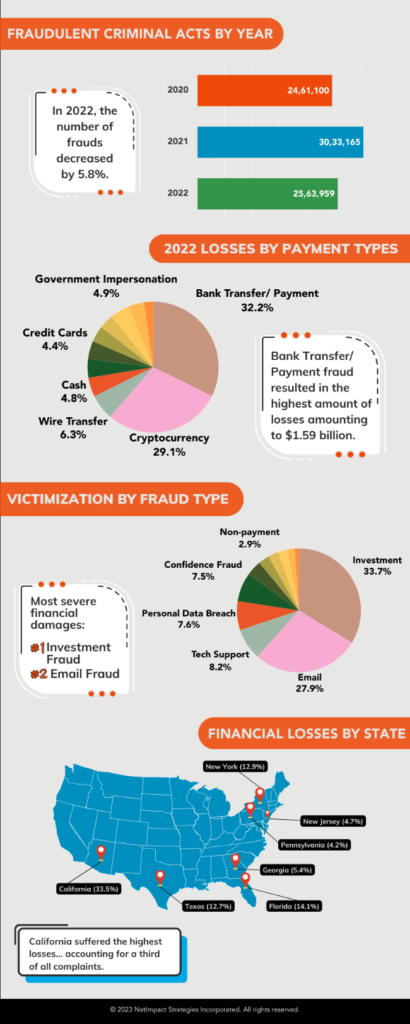

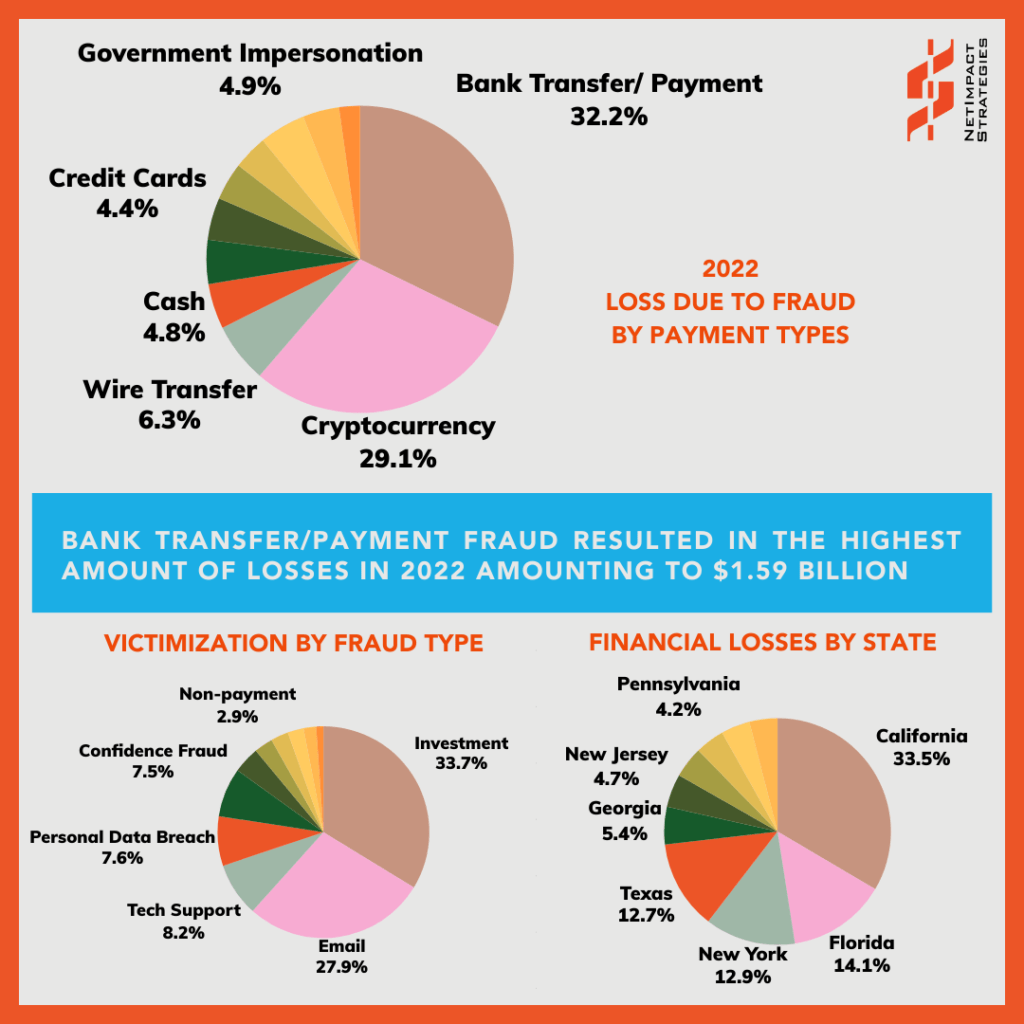

The Federal Trade Commission (FTC) data shows that, in 2022, Americans suffered a substantial loss of $8.8B across from more than 2.5Mi criminal fraud acts – an alarming increase of 30%+ loss compared to 2021.

FTC research shows victims in 2022 suffered an increase of 30% in loss due to fraud crimes than in 2021.

Fraudulent acts are committed when someone intentionally uses false or misleading information to unlawfully gain access to information or obtain rights and services of the victim.

| Exposing the Truth Behind ‘Operation Opioid Deceit’: A Widespread Fraud that Rocked the Nation Operation Opioid Deceit sheds light on a complex healthcare fraud network exploiting telehealth services for the forgery of opioid prescriptions and became one of the most prominent criminal frauds exposed. The operation resulted in substantial financial losses exceeding $6 Billioniv, exacerbating the opioid crisis and emphasizing the need for a comprehensive strategy to combat multifaceted criminal tactics. |

The landscape of criminal fraud takes various forms in the U.S., with healthcare fraud gaining prominence from the well-orchestrated acts like Operation Opiod Deceit. In 2021, the Department of Justice (DOJ) took decisive action against false charges for telehealth services, charging over 138 medical professionals with healthcare fraud that caused $1.4Bv in alleged losses. This lucrative scheme included prescriptions forges for controlled substances from Schedule I – III, posing a severe threat to public health and safety in addition to financial victimization.

Other common types of fraudulent crimes include the following:

- Identity theft involves the illicit acquisition of personal information to commit fraud.

- Credit card fraud entails the unauthorized use of credit card information for purchases.

- Investment fraud deceives investors by misrepresenting or omitting critical information about investment opportunities.

- Insurance fraud involves false claims to insurance companies for benefits or compensation.

- Email fraud happens when cybercriminal uses email to trick people into revealing personal information or transfers money to fraudulent accounts.

- Personal data breach happens when a breach of security leads to accidental or unlawful destruction, loss, alteration, unauthorised disclosure of personal data.

- Confidence fraud happens when con artist gains victim’s trust and then defrauds them.

- Spoofing is a cybercrime where criminals try to obtain personal information by pretending to be a trusted business or source to steal personal information, money, or data.

The penalties for fraud are commensurate with the type of fraud, the number of victims, and the financial losses incurred. Punishment typically involves a prison sentence, restitution orders, and fines, aiming to deter potential wrongdoers and restore financial integrity to victims.

Fraudulent crimes can have a devastating impact on the victims beyond the immediate financial loss, like causing trauma. Victims may feel anxiety, shame, embarrassment, guilt, anger, depression, fear, loss of trust in others, sadness, betrayal, etc. As victims work to process these complex emotions, they may also be hesitant to tell others or rely on their network for support due to fear of criticism or the shame associated with the experience. This can lead to additional feelings of isolation and these feeling of betrayal and violation of trust can shatter a victim’s sense of self-worth and confidence, eroding their mental wellbeing.

How much ever anxiety or betrayal victim may feel due to being scammed, they must remember that they are not alone.

What You Should Do If You’ve Been Scammed?

There are millions of people who become victim of scams every year – these crimes happen because they work.

- Stay calm and stop all contact with the scammer

- Connect with your bank immediately

- Report the scam to your local police station

- Report the scam to the Federal Trade Commission (FTC)

- Keep copies of all communication with the

- Seek support from your family or a trustworthy person

- Set a fraud alert on your credit files

- Change your passwords for all your online accounts

Taking the first step and reporting the crime immediately will not only help victims receive timely support, but also can aid investigators in their research or prevent others from becoming victims. There are several agencies working towards combating the issue of fraud: FTC provides a centralized platform to report fraudulent activity, including scams, identity theft, and deceptive business practices; Consumer Financial Protection Bureau (CFPB) supervises banks, credit card companies, credit reporting agencies, to ensure they comply with consumer protection laws and regulations, for prevention of fraud and unfair practices in the financial services industry; National Crime Prevention Council (NCPC) develops and disseminates crime prevention resources and training programs to law enforcement agencies and community organizations; and the Federal Bureau of Investigation (FBI) plays a pivotal role in combating fraud through collaborative efforts with partner law enforcement and regulatory agencies, including the Securities and Exchange Commission (SEC), Internal Revenue Service (IRS), U.S. Postal Inspection Service (USPS), Commodity Futures Trading Commission (CFTC), and Treasury’s Financial Crimes Enforcement Network (FinCEN) or Internal Revenue Service Criminal Investigation (IRS-CI) agencies.

Deterring criminal fraudulence requires constant vigilance, critical thinking, and active information security measures. While taking a personal vigilance of protecting your information seems to be the most basic step, it may be the most effective. Stay sharp on fraud tactics and guard your information against suspicious strangers. Why do criminals still run the Auto Warranty Scams? Simply because it works – so be sure to educate yourself on the signs from official sources, like FCC’s Consumer Guide on Auto Warranty Scamsvi.

In addition to your cooperation, law enforcement agencies need the right tools to combat fraudulent activities in today’s digitized world. DX360°® Investigative Case Manager (ICM) is a powerful tool that assists investigators in managing complex cases, identifying patterns, and tracking down suspects. With smart analytics that reveal common themes and trends across cases, DX360°® ICM is a must-have investigative partner for preventing fraudulent activities and earlier restoral of justice to the victims.